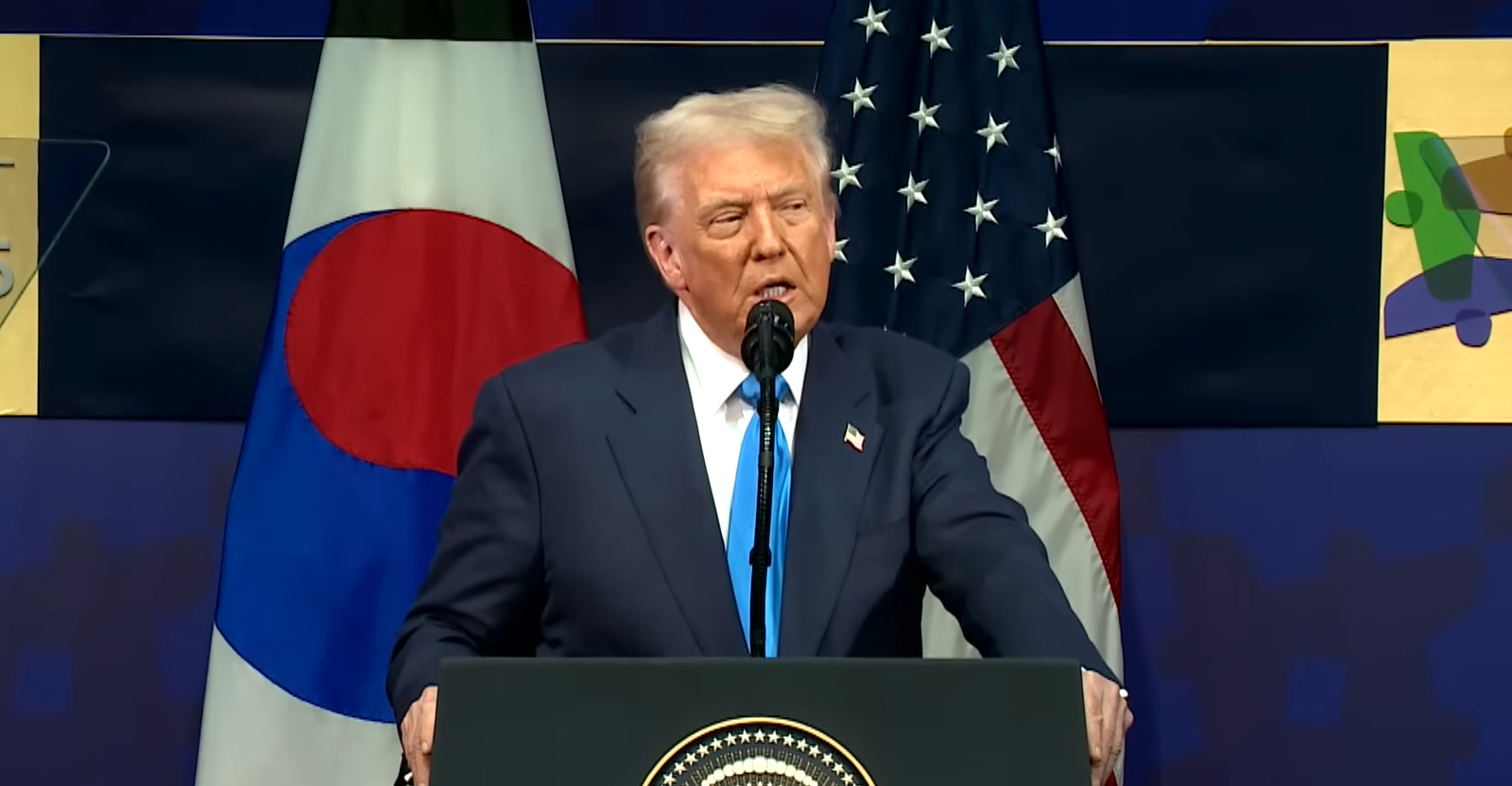

Donald Trump doesn’t seem to have a good grasp of basic economics (see his lack of understand that tariffs raise prices or a about million other things), but he does feel that he should be able to dictate how the economy works to an incredible and concerning degree. That now includes the stock market. During a keynote address at luncheon for CEOS at Asia-Pacific Economic Cooperation (APEC) conference he said this:

But, you know, in the old days, when you announce good news, the stock market went up. You announce good news, the stock market would go up. Now, when you announce good news, the stock market goes down because think people say, “Oh, that’s terrible. You’re doing well. That’s terrible. Interest rates will go up.” So, they think because of that, interest rates will go up. It goes down. It’s inverse of what it should be. We’re going to go back to the way it used to be. When we announce good news, the stock markets are going to go up. And that’s the way it should be. And we’re going to really ride that very hard. And when we announce good news, we’re not going to have a Fed that’s going to raise interest rates because they’re worried about inflation in three years from now or something. When we announce good news, we want the stock market to go up, not to go down.

Among the issue with that, is that the economy has gone up this year, which would mean that there is continued bad news. Another issue is how exactly would you force the stock market to move in the direction you want in response to news.

The most reasonable interpretation of what he is suggesting is that he is going to force the Federal Reserve to not raise interest rates when that is warranted. So news that would prompt people to assume rates to go up, wouldn’t cause that for at time. (With harmful inflation likely to follow.) A less reasonable interpenetration would be that he wants to take action against stock market exchanges or investors.

Leave a Reply